Coin vs Token Whats the Difference? A Clear Guide

Coin vs Token: What’s the Difference? This intriguing topic dives into the fundamental aspects of cryptocurrency, where coins and tokens serve distinct purposes in the digital economy. As we unravel these concepts, you’ll discover how each plays a unique role in blockchain technology and broader financial systems.

Coins are primarily digital currencies that operate on their own blockchain, like Bitcoin and Ethereum, and are used mainly for transactions. Tokens, on the other hand, represent various assets or utilities and can exist on existing blockchains, leveraging smart contracts for their functionality. Understanding these differences is essential for anyone looking to navigate the evolving landscape of digital currencies.

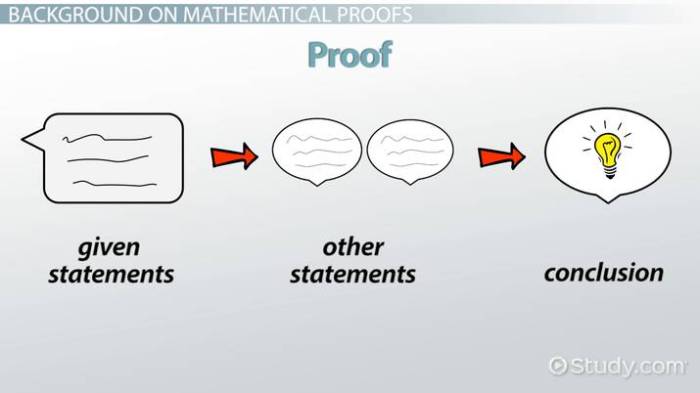

Understanding Coins

Source: wikimedia.org

In the cryptocurrency world, the term “coin” refers to a digital currency that operates independently on its own blockchain. Coins are typically designed to serve as a medium of exchange, a store of value, or a unit of account, much like traditional currencies but in a digital format. Understanding the fundamental characteristics and functionalities of coins is essential for anyone looking to navigate the crypto landscape effectively.Coins are built on their own blockchain technology, which serves as a decentralized ledger where transactions are recorded and verified without the need for intermediaries.

This decentralized nature enhances security and transparency in transactions. Some of the most notable examples of coins include Bitcoin, Ethereum, and Litecoin.

Examples of Popular Coins and Their Functionalities

Several coins have gained significant traction in the market, each with unique functionalities. The following list highlights some of the most popular coins and their primary uses:

- Bitcoin (BTC): The first and most well-known cryptocurrency, Bitcoin serves primarily as a digital currency and a store of value, enabling peer-to-peer transactions without intermediaries.

- Ethereum (ETH): More than just a digital currency, Ethereum supports smart contracts and decentralized applications (dApps), allowing developers to create complex functionalities on its blockchain.

- Litecoin (LTC): Often regarded as the silver to Bitcoin’s gold, Litecoin offers faster transaction times and lower fees, making it suitable for everyday transactions.

- Ripple (XRP): Focused on facilitating international bank transfers, Ripple aims to provide a secure and instant payment solution for financial institutions.

- Cardano (ADA): Known for its research-driven approach, Cardano aims to offer a sustainable platform for dApps and smart contracts with an emphasis on security and scalability.

The technology behind coins is pivotal to their functionality. Blockchain technology operates on a distributed network of nodes, where each node maintains a copy of the entire ledger. This consensus mechanism ensures that transactions are verified by multiple parties, reducing the risk of fraud.

“The decentralized nature of blockchain technology enhances security and transparency in transactions.”

Coins can also be influenced by various factors such as market demand, technological advancements, and regulatory changes, which further shapes their functionalities and adoption in the real world. By understanding these aspects, users can make more informed decisions in the ever-evolving cryptocurrency market.

Understanding Tokens

In the cryptocurrency landscape, tokens represent a fundamental component that serves various purposes beyond merely functioning as digital currency. Unlike coins, which typically operate on their own blockchain, tokens are created and utilized on existing blockchains, often leveraging the capabilities of smart contracts. This distinction is essential in understanding the diverse applications of tokens in the crypto ecosystem.Tokens can be classified into several categories based on their functionality and intended use.

The most common types include utility tokens, security tokens, and stablecoins. Each of these categories plays a distinct role within the crypto space, addressing different user needs and investment strategies.

Types of Tokens

Understanding the various types of tokens is crucial for navigating the cryptocurrency market. Each type has specific characteristics, benefits, and use cases that cater to different audiences. Utility tokens are designed to provide users with access to a product or service within a blockchain ecosystem. They often serve as a medium of exchange within their respective platforms, enabling users to participate in activities such as purchasing goods or accessing features.

A prominent example of a utility token is the Binance Coin (BNB), which users utilize for trading fee discounts on the Binance exchange.Security tokens, on the other hand, represent ownership in an asset or company. They are subject to federal securities regulations and often require compliance with legal frameworks. These tokens may provide holders with dividends or a share of profits, similar to traditional securities.

A well-known example is the tZERO token, which is designed to offer fractional ownership in real-world assets.Stablecoins aim to maintain a stable value by pegging themselves to a reserve asset like the US dollar or gold. This stability enables users to hold and transact in cryptocurrencies without experiencing the volatility typically associated with digital currencies. Tether (USDT) and USD Coin (USDC) are examples of stablecoins that have gained significant traction in the market.Smart contracts are pivotal in the creation and management of tokens.

These self-executing contracts with the terms of the agreement directly written into code enable seamless and automated transactions without the need for intermediaries. Smart contracts facilitate token issuance, governance, and compliance, ensuring that the token’s functionalities are executed as intended. For instance, Ethereum’s ERC-20 and ERC-721 standards provide frameworks for the creation of fungible and non-fungible tokens, respectively, allowing developers to build a wide range of applications on the Ethereum blockchain.In summary, tokens are diverse and serve a multitude of purposes within the cryptocurrency ecosystem.

Their classification into utility, security, and stablecoins illustrates their varied applications and how smart contracts enhance their functionalities.

Key Differences Between Coins and Tokens

The distinction between coins and tokens is essential for anyone navigating the cryptocurrency landscape. While both serve as digital assets in the blockchain ecosystem, they have different characteristics, functionalities, and applications. Understanding these differences will help users make informed decisions about their investments and the technologies they engage with in the digital finance space.One of the primary ways to differentiate coins from tokens is by examining their core features.

Coins are typically associated with their own blockchains and are primarily used as a medium of exchange or a store of value. On the other hand, tokens are built on existing blockchains and often serve specific purposes within a particular ecosystem. This fundamental difference influences their use cases, economic implications, and overall functionality.

Comparison of Features

When comparing coins and tokens, it is vital to consider their distinct properties and uses. The following points highlight these differences:

- Blockchain Independence: Coins operate on their own blockchain, such as Bitcoin on the Bitcoin blockchain or Ether on the Ethereum blockchain.

- Built on Existing Blockchains: Tokens rely on existing blockchains to operate, like ERC-20 tokens on the Ethereum platform, which utilize its infrastructure.

- Functionality: Coins primarily function as currencies for transactions, while tokens can represent a wide variety of assets or utilities, such as voting rights, access to services, or even as assets in decentralized finance (DeFi) applications.

- Value Proposition: Coins generally have a straightforward value proposition tied to their scarcity and utility as a currency, whereas tokens may derive their value from their specific use cases within an application or ecosystem.

Use Cases in Real-World Applications

The practical applications of coins and tokens vary significantly, reflecting their differing functionalities. Coins are typically employed in the following ways:

- Transactions: Coins like Bitcoin and Litecoin are used for peer-to-peer transactions, allowing users to send and receive value directly without intermediaries.

- Store of Value: Many investors view coins as a form of digital gold, using them to preserve wealth and hedge against inflation.

Conversely, tokens serve diverse purposes, often tailored to specific platforms or services:

- Access to Services: Utility tokens like Binance Coin (BNB) allow users to access and pay for services within the Binance ecosystem.

- Incentives and Rewards: Some tokens are designed to incentivize user behavior, rewarding participants in DeFi platforms or loyalty programs.

Economic Implications of Transactions

The economic implications of using coins versus tokens in transactions are essential for understanding their impact on the broader market. Coins typically offer lower transaction fees and faster processing times when used for direct transactions. In contrast, tokens may entail higher fees due to the complexity of smart contracts and additional functionalities they provide.

Coins serve as a straightforward medium of exchange, while tokens often introduce unique functionalities linked to specific ecosystems.

The choice between using coins or tokens can also influence market dynamics. In general, coins tend to have more straightforward monetary policies, while the value of tokens can be influenced by factors such as demand for a particular service or platform, regulatory changes, and overall market sentiment. As a result, users should evaluate the economic context of their transactions carefully, considering both the immediate costs and the long-term implications of their choices in the cryptocurrency space.

Use Cases for Coins

Coins play a pivotal role in the cryptocurrency ecosystem by serving various functions that enhance their utility in modern finance. Unlike tokens, which often represent assets or access to applications, coins typically function as digital money, facilitating transactions and serving as a vehicle for value storage. Understanding the unique scenarios where coins are most effectively utilized sheds light on their significance in the digital economy.Coins are predominantly used in transactions that require a reliable medium of exchange.

They contribute to the digital economy by providing a decentralized alternative to traditional fiat currencies. Here are some of the key scenarios where coins are effectively utilized:

Medium of Exchange

Coins are primarily designed to function as a medium of exchange, allowing users to buy goods and services. Their decentralized nature helps in reducing transaction fees and eliminating intermediaries. A few notable examples include:

- Online Purchases: Many e-commerce platforms now accept cryptocurrencies like Bitcoin and Ethereum as payment for products and services, allowing customers to make direct transactions without the need for credit cards or banks.

- Remittances: Coins can facilitate faster and cheaper cross-border payments, making them ideal for sending money internationally. For instance, using cryptocurrencies can significantly reduce remittance fees compared to traditional money transfer services.

- Micropayments: Coins enable the execution of micropayments, which are small transactions that may not be feasible with traditional financial systems. This is particularly relevant for content creators who rely on tips or small payments for their work.

Store of Value

Another significant use case for coins is their function as a store of value. Many investors view certain cryptocurrencies as a hedge against inflation and economic instability. This perception is based on:

- Scarcity: Coins like Bitcoin have a capped supply, which can increase their value over time as demand rises. Holders may store coins with the expectation that prices will appreciate.

- Digital Gold: Bitcoin is often referred to as “digital gold” due to its store of value characteristics. Investors use it to diversify their portfolios and protect wealth, similar to how one would invest in gold.

- Protection Against Economic Turmoil: In countries facing hyperinflation or unstable currencies, citizens have turned to cryptocurrencies to safeguard their purchasing power and maintain financial independence.

Impact on Digital Economies

The introduction of coins has significantly transformed financial systems worldwide. They have introduced new economic models and opportunities for innovation. Coins foster:

- Decentralization: Coins promote decentralized financial systems that empower individuals by providing them control over their finances without the need for central authorities.

- Increased Accessibility: Coins provide financial access to unbanked populations, enabling anyone with internet access to participate in the global economy.

- Investment and Speculation: The rapid growth of coins has created new investment opportunities, attracting both retail and institutional investors, thereby influencing market dynamics.

Coins’ functionality as a medium of exchange and store of value illustrates their key role in shaping the future of finance and digital economies. Their impact is evident as they continue to influence how transactions are conducted, wealth is stored, and financial systems are structured globally.

Use Cases for Tokens

Tokens serve various purposes in the blockchain ecosystem, providing unique functionalities that extend beyond simple currency use. They often represent digital assets, facilitate access to platforms, or enable participation in decentralized applications (dApps). The versatility of tokens makes them integral to several innovative use cases across industries.Token-based systems are particularly beneficial as they can streamline access to services or products.

This is especially relevant in sectors such as finance, healthcare, and entertainment, where tokens can be used to authenticate users, grant permissions, or enable transactions. As a result, they foster a more efficient and secure environment for both service providers and users.

Facilitation of Access to Services or Products, Coin vs Token: What’s the Difference?

Tokens can act as digital keys that unlock specific features or services on a platform. When users hold tokens, they often gain access to exclusive functionalities that enhance their experience. Here are some examples of how tokens facilitate access:

- Membership Access: In many subscription services, holding a specific token can grant users premium access or benefits that non-holders cannot access.

- Voting Rights: In decentralized governance models, token holders usually have the ability to vote on key decisions, ensuring that they have a say in the platform’s development.

- Transaction Privileges: Certain tokens may confer lower transaction fees or priority processing for holders, incentivizing users to engage more with the platform.

- Exclusive Content: In the entertainment industry, tokens can unlock special content or experiences, such as early access to releases or exclusive merchandise.

Token-Based Fundraising Methods

Token-based fundraising has revolutionized how projects secure capital. Methods like Initial Coin Offerings (ICOs) and Security Token Offerings (STOs) have become popular methods for startups and established firms to raise funds while providing investors with a stake in the project. Here’s an overview of these fundraising methods:

- Initial Coin Offerings (ICOs): These enable companies to issue tokens to investors in exchange for cryptocurrencies, often used to fund new projects. ICOs gained popularity during the 2017 crypto boom, allowing developers to bypass traditional funding routes.

- Security Token Offerings (STOs): STOs are regulated offerings where tokens represent ownership in an asset, such as equity in a company or real estate. This method combines the benefits of traditional investment securities with blockchain technology, ensuring compliance with regulations.

- Decentralized Autonomous Organizations (DAOs): Tokens can represent voting rights in DAOs, allowing members to fund initiatives, manage resources, and govern the organization collectively.

“Token-based fundraising has opened the door for innovative projects to gain the financial backing they need, while providing investors with a more liquid and accessible means of investment.”

Regulatory Aspects

The regulatory environment surrounding cryptocurrencies is complex and continually evolving, particularly between coins and tokens. As these digital assets gain prominence, governments and regulatory bodies worldwide are striving to establish frameworks that can effectively manage their unique characteristics and risks.The classification of an asset as a coin or token significantly impacts its regulatory treatment. Coins, typically seen as currencies or mediums of exchange, often face different scrutiny compared to tokens, which may represent assets or utilities within specific ecosystems.

This distinction can lead to varying degrees of regulatory oversight, depending on the intended use, structure, and functionality of the asset.

Global Regulatory Landscape

A diverse array of regulations affects coins and tokens around the world, each reflecting the unique legal, economic, and technological contexts of their jurisdictions. Understanding these regulatory frameworks is essential for anyone involved in the cryptocurrency space.The following key regulations are notable in shaping the environment for coins and tokens globally:

- U.S. Securities and Exchange Commission (SEC): The SEC has classified certain tokens as securities, thus requiring them to comply with securities regulations. This has led to significant legal actions against projects deemed to have violated these rules, emphasizing the importance of proper classification.

- European Union’s MiCA Regulation: The proposed Markets in Crypto-Assets (MiCA) regulation aims to create a unified legal framework for cryptocurrencies in the EU. It seeks to clarify the definitions of coins and tokens, ensuring better consumer protection and market integrity.

- Financial Action Task Force (FATF): The FATF provides guidance on anti-money laundering (AML) and combating the financing of terrorism (CFT) for virtual assets. Their regulations apply to both coins and tokens, influencing how exchanges operate globally.

- Japan’s Financial Services Agency (FSA): Japan recognizes cryptocurrencies as a legal form of payment. The FSA regulates exchanges to protect consumers, highlighting the importance of regulatory clarity in supporting market growth.

- China’s Cryptocurrency Ban: In contrast, China has taken a strict stance against cryptocurrencies, banning initial coin offerings (ICOs) and trading of tokens. This approach underscores the wide variance in regulatory attitudes across jurisdictions.

The growing recognition of cryptocurrencies has led to increased regulatory scrutiny, with governments aiming to balance innovation with consumer protection. As the landscape evolves, both coins and tokens will continue to navigate a patchwork of regulations that can significantly impact their use, development, and acceptance in the global marketplace.

“The classification of a digital asset directly influences its regulatory obligations and market dynamics.”

Future Trends: Coin Vs Token: What’s The Difference?

Source: wikimedia.org

As the cryptocurrency landscape continues to evolve, both coins and tokens are positioned to reflect significant changes influenced by technological advancements and market dynamics. Understanding these potential future developments is crucial for investors, developers, and users alike, as they navigate the complexities of digital assets and their applications.The future of the coin and token markets appears promising, with several emerging technologies poised to enhance their functionality and user experience.

Innovations such as blockchain scalability solutions, interoperability protocols, and advancements in decentralized finance (DeFi) are set to influence how coins and tokens operate and interact within the broader financial ecosystem.

Emerging Technologies

The integration of new technologies is expected to redefine the landscape of coins and tokens in the coming years. Several key technologies are particularly noteworthy:

- Layer-2 Solutions: Technologies like Ethereum’s Layer-2 scaling solutions (e.g., Optimistic Rollups, zk-Rollups) are designed to increase transaction throughput while reducing costs, making coins and tokens more efficient for everyday transactions.

- Interoperability Protocols: Innovations such as Polkadot and Cosmos enable different blockchains to communicate seamlessly. This could lead to a future where coins and tokens are not limited to their native ecosystems, allowing for cross-chain transactions and enhanced liquidity.

- Decentralized Finance (DeFi): The growth of DeFi platforms will continue to reshape the utility of tokens, offering users innovative financial products like lending, staking, and yield farming, which can enhance their value and adoption.

Evolving Public Perception

Public perception plays a critical role in the acceptance and growth of coins and tokens. As education surrounding cryptocurrencies increases, the understanding of their differences is becoming clearer among investors and the general public.

“Awareness and comprehension of coins and tokens are essential for fostering trust and encouraging broader adoption.”

Various factors are influencing this evolution, including:

- Institutional Adoption: As more institutional investors enter the cryptocurrency market, the legitimacy of coins and tokens is bolstered, encouraging wider public interest.

- Media Coverage: Increased media attention on blockchain technology and notable examples of successful projects is shifting public perception from skepticism to curiosity and acceptance.

- Education Initiatives: Educational resources and platforms dedicated to crypto literacy are enhancing understanding, which is crucial in distinguishing between coins and tokens and their respective roles in the economy.

These trends suggest a future where coins and tokens not only coexist but also thrive in sectors such as finance, supply chain, and gaming, thus broadening their use cases and enhancing their relevance in everyday transactions.

Conclusion

Source: publicdomainpictures.net

In summary, grasping the distinction between coins and tokens not only enhances your knowledge of cryptocurrency but also informs your investment decisions and usage in the digital economy. As the market continues to evolve and new technologies emerge, being well-versed in these differences will be crucial in understanding their implications and potential future trends.

FAQ Resource

What is a cryptocurrency coin?

A cryptocurrency coin is a digital currency that operates on its own blockchain, used primarily as a medium of exchange or store of value.

What is a cryptocurrency token?

A cryptocurrency token is a digital asset created on an existing blockchain, often representing various forms of assets or utility, and can be associated with smart contracts.

Can tokens be used for transactions like coins?

Yes, tokens can be used for transactions, but their primary purpose often revolves around providing access to services or fulfilling specific functions within a platform.

Are coins more valuable than tokens?

Not necessarily; the value of both coins and tokens depends on various factors, including use case, demand, and market conditions.

How do regulations differ for coins and tokens?

Regulations can differ significantly based on how an asset is classified; coins may be viewed as currencies, while tokens might fall under securities laws depending on their characteristics.