Why Market Sentiment Plays a Big Role in Crypto Trading

Why Market Sentiment Plays a Big Role in Crypto Trading sets the stage for an engaging exploration into the intricate dynamics that shape the cryptocurrency landscape. In a market where emotional responses often overshadow fundamental analysis, understanding market sentiment becomes essential for traders looking to navigate volatility and make informed decisions. By grasping the nuances of investor psychology and the social influences at play, one can better anticipate price movements and optimize trading strategies.

Market sentiment reflects the overall attitude and emotions of investors within the crypto market, driving both bullish and bearish trends. This emotional landscape can be influenced by various factors, including news events, social media buzz, and broader economic indicators, making it a crucial element for any trader’s toolkit.

Understanding Market Sentiment

Market sentiment refers to the overall attitude of investors toward a particular market or asset. It encapsulates the collective emotional and psychological state of the market participants, influencing their buying and selling decisions. In financial markets, sentiment can sway prices dramatically, as traders react not only to fundamental factors but also to their perceptions and feelings about those factors.In the realm of cryptocurrency, where volatility is a defining characteristic, market sentiment can have an even more pronounced effect.

Unlike traditional markets driven by earnings reports or economic indicators, the crypto market is heavily influenced by social media, news events, and community discussions. For instance, a tweet from a prominent figure can lead to sudden price shifts, reflecting the power of sentiment in this space. The emotional responses to regulatory news, technological developments, and market trends can exacerbate price movements, making sentiment analysis a crucial tool for traders looking to navigate the unpredictable waters of crypto trading.

Market Sentiment Indicators

Several indicators can help traders gauge market sentiment. These indicators serve as tools to interpret the emotions and expectations of the market participants. Understanding these indicators can aid traders in making informed decisions. One commonly used sentiment indicator is the Fear and Greed Index. This index aggregates various factors to assess whether the market is in a state of fear or greed, providing a numerical value that traders can react to.

When the index indicates extreme fear, it could signal a buying opportunity, while extreme greed may suggest a market correction could be imminent.Another important tool is social media sentiment analysis, where traders analyze social media platforms for buzz around specific cryptocurrencies. By monitoring the volume of discussions and sentiment surrounding a particular coin, traders can gain insights into potential price movements.

Finally, on-chain analysis provides a deeper look into market sentiment by examining blockchain data such as transaction volumes, wallet activity, and exchange inflows/outflows. These metrics can reveal whether traders are accumulating assets or selling off their holdings, allowing for a more nuanced understanding of market behavior.

Market sentiment acts as a lens through which traders can interpret the emotional landscape of the crypto market, providing insights that may not be immediately evident through traditional analysis.

Psychological Factors in Trading

Source: empathyrooms.com

The crypto market is not just driven by charts and numbers; it is deeply influenced by the psychological factors that govern investor behavior. Understanding these elements is crucial for anyone looking to navigate the often volatile waters of cryptocurrency trading. Emotions can greatly impact decisions, leading to both profitable and detrimental outcomes. The interplay of fear and greed, amplified by the fast-paced nature of the market, creates a unique psychological environment that traders must learn to recognize and manage.The psychological landscape in cryptocurrency trading is shaped by a variety of factors.

Traders often find themselves caught in a cycle of emotional highs and lows, driven by market performance and external influences. This environment can lead to impulsive decisions, where traders act on their feelings rather than on informed strategies.

Influence of Fear and Greed on Decision-Making

Fear and greed are the two primary emotions that influence trading behavior. Fear can lead to panic selling, while greed often drives traders to take excessive risks. The following Artikels how these emotions manifest and impact decision-making:

Fear of Missing Out (FOMO)

This phenomenon occurs when traders feel an urgent need to invest due to the fear of missing potential profits from rising prices. It often results in hasty decisions without adequate research or strategy.

Fear of Loss

Traders may sell their assets prematurely to avoid further losses, which can undermine long-term investment strategies. This fear often leads to locking in losses rather than allowing time for recovery.

Greed and Overconfidence

When prices are rising, traders may succumb to greed, pushing them to invest larger amounts than they normally would. This overconfidence can lead to irrational decisions and substantial financial risk.The impact of these emotions can be exacerbated in the crypto market, where price volatility is a common occurrence.

Impact of Social Media and News on Trader Psychology, Why Market Sentiment Plays a Big Role in Crypto Trading

Social media platforms and news outlets have a profound effect on trader sentiment, shaping perceptions and influencing decisions almost instantaneously. The following points highlight the significance of these external factors:

Real-Time Information Flow

Social media allows for rapid dissemination of information, where news can lead to sudden price shifts. Traders often react quickly to trending topics, which can create herd behavior and amplify market movements.

Influence of Public Figures

The opinions of influential figures in the crypto space can sway public sentiment. For example, tweets from well-known personalities can trigger massive buying or selling waves, often unrelated to fundamental analysis.

Echo Chambers and Confirmation Bias

Traders may gravitate towards information that reinforces their existing beliefs, creating echo chambers. This can skew judgment and lead to poor trading decisions based on biased or incomplete information.In conclusion, the psychological factors influencing trading behavior in the crypto market underscore the importance of emotional awareness and critical thinking. As traders navigate this environment, recognizing the effects of fear, greed, social media, and news will be vital for making informed decisions and achieving success in their trading endeavors.

Impact of Market Sentiment on Price Movements

Source: kestreltellevate.com

Market sentiment is an expression of the overall attitude of investors toward a particular financial market or asset. In the realm of cryptocurrency trading, this sentiment can have profound implications for price movements. The emotional responses of traders—often driven by news, social media, or global events—can lead to significant fluctuations in cryptocurrency values. Understanding the correlation between market sentiment and price movements is essential for traders looking to navigate this volatile landscape effectively.Market sentiment acts as a barometer for price fluctuations in cryptocurrencies, where positive or negative emotions can lead to swift and drastic changes in valuation.

A bullish market sentiment often results in increased buying activity, pushing prices higher, while bearish sentiment can trigger sell-offs and price drops. This correlation is evident through various case studies where public perception and reactions have directly influenced market behavior.

Correlation Between Market Sentiment and Price Fluctuations

The relationship between market sentiment and price movements in cryptocurrencies can be illustrated through several key factors. These factors encompass trader psychology, media influence, and community dynamics that collectively create a feedback loop impacting asset valuation.

- Investor Behavior: Emotional trading, driven by fear of missing out (FOMO) or fear, can lead to rapid price changes. For example, during the 2017 Bitcoin bull run, heightened public interest and media coverage resulted in unprecedented price spikes, often disconnected from underlying fundamentals.

- News Events: Major announcements, regulatory developments, or technological advancements can sway market sentiment significantly. The announcement of Tesla’s investment in Bitcoin in early 2021 caused a surge in prices, reflecting a positive shift in sentiment.

- Social Media Influence: Platforms like Twitter and Reddit have become powerful tools for shaping market sentiment. The GameStop saga in early 2021 showcased how community-driven movements can influence stock prices, a phenomenon that is equally applicable in the crypto space.

Case Studies of Significant Price Movements

Analyzing historical events reveals how market sentiment has led to dramatic price movements in cryptocurrencies. These case studies underscore the importance of sentiment in understanding price dynamics.

- Bitcoin’s Rise in 2017: Fueled by media hype and public interest, Bitcoin’s price skyrocketed from under $1,000 in January to nearly $20,000 by December 2017, showcasing how positive sentiment propelled market activity.

- The 2020 DeFi Boom: The rise of Decentralized Finance (DeFi) projects sparked excitement within the crypto community, leading to significant investment and price increases for numerous cryptocurrencies, driven largely by optimistic sentiment regarding innovative financial products.

- China’s Regulatory Crackdown (2021): The announcement of China’s ban on cryptocurrency transactions in May 2021 resulted in a rapid decline in prices across the board, exemplifying how negative sentiment can trigger widespread sell-offs.

Historical Events Shaping Market Sentiment and Trading Patterns

Historical events play a crucial role in shaping market sentiment and the associated trading patterns. Understanding these events provides insights into how they influence future market behavior.

- Mt. Gox Collapse (2014): The hack of the Mt. Gox exchange severely impacted market sentiment, resulting in a significant loss of investor confidence and a downturn in Bitcoin prices for years.

- Bitcoin Halving Events: Historical halving events have consistently led to bullish sentiment, driving prices upward as traders anticipate decreased supply and increased demand.

- COVID-19 Pandemic (2020): The global economic uncertainty created by the pandemic led to a resurgence in interest for cryptocurrencies as alternative investments, showcasing how external events can shift sentiment rapidly.

Tools for Gauging Market Sentiment

Understanding market sentiment is crucial for making informed trading decisions in the cryptocurrency landscape. A variety of tools and platforms have emerged to assist traders in gauging the mood of the market, offering insights that can significantly impact trading strategies. These tools utilize advanced methodologies to analyze data and interpret the collective feelings of market participants, turning qualitative sentiment into actionable trading signals.

Popular Tools and Platforms for Market Sentiment

Several established tools and platforms are widely used to assess market sentiment. Each tool employs different methodologies to gather and analyze data, providing valuable insights into trader psychology and market movements.

- Crypto Fear and Greed Index: This tool measures market sentiment on a scale from extreme fear to extreme greed. It aggregates various data points, including volatility, market momentum, social media activity, and Google Trends to produce a score that reflects the current sentiment in the cryptocurrency market.

- Sentiment Analysis Platforms: Tools like LunarCRUSH and Santiment specialize in analyzing social media sentiment and other online activities. They use natural language processing (NLP) algorithms to gauge public sentiment on platforms like Twitter and Reddit, providing traders with insights into community sentiment.

- Market Sentiment Indicators: Indicators such as the Long/Short Ratio and Open Interest help traders understand the prevailing sentiment among market participants. The Long/Short Ratio compares the number of long positions to short positions, while Open Interest measures the total number of outstanding contracts, indicating whether the market is leaning bullish or bearish.

Methodologies Used in Sentiment Analysis

The methodologies employed by sentiment analysis tools vary, but they primarily focus on data collection, analysis, and interpretation. The following methods are commonly used:

- Social Media Monitoring: Platforms analyze vast amounts of data from social media channels to track sentiment by identifying positive, negative, or neutral mentions of cryptocurrencies.

- News Sentiment Analysis: Tools scan news articles and press releases, employing NLP techniques to categorize news as either bullish or bearish, thus influencing market perception.

- Surveys and Polls: Some tools conduct surveys or polls among traders to gather direct sentiment feedback, providing a snapshot of trader confidence and market outlook.

Advantages and Limitations of Sentiment Analysis

Utilizing sentiment analysis in trading strategies offers several advantages, though it is essential to recognize its limitations as well.

- Advantages:

- Provides insights into collective market psychology, helping traders anticipate price movements.

- Can serve as an early warning system for potential market reversals or trends.

- Enhances traditional technical analysis by incorporating human emotions into trading strategies.

- Limitations:

- Market sentiment can change rapidly, making it difficult to predict long-term trends based on short-term sentiment data.

- Over-reliance on sentiment analysis may lead to poor decision-making if not combined with other trading strategies.

- Sentiment data can be subjective and prone to manipulation, particularly in highly volatile markets like cryptocurrencies.

“Market sentiment is often the driving force behind price movements, making it a crucial element in the decision-making process for traders.”

Strategies for Trading Based on Market Sentiment

Source: digitalbloggers.com

Understanding market sentiment can significantly enhance your trading strategy, especially in the dynamic world of cryptocurrencies. By analyzing collective investor behavior, traders can make more informed decisions that align with market trends and movements. This section delves into effective trading strategies that incorporate sentiment analysis.

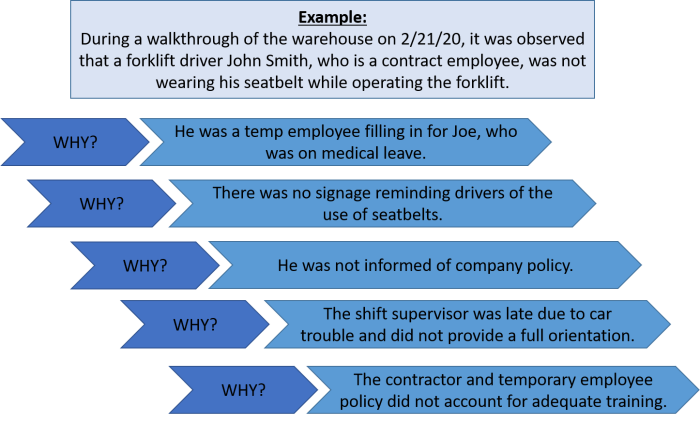

Designing a Trading Strategy with Market Sentiment Analysis

Creating a trading strategy that effectively utilizes market sentiment involves several key components. First, traders should establish a clear understanding of the market dynamics at play. This includes identifying the prevailing market sentiment—whether bullish or bearish. Once this is defined, traders can formulate their strategy, which typically includes entry and exit points based on sentiment indicators.The strategy may include:

- Identifying key sentiment indicators such as Fear & Greed Index, social media trends, and news sentiment analysis.

- Setting specific thresholds for sentiment indicators that trigger buy or sell signals. For example, if the Fear & Greed Index shows extreme fear, it may be a signal to buy.

- Incorporating technical analysis alongside sentiment insights to confirm trading signals. For example, if sentiment is bullish but technical indicators suggest overbought conditions, one might reconsider entering a position.

Step-by-Step Guide for Leveraging Sentiment Indicators in Trading Decisions

Incorporating sentiment indicators into your trading decisions can be streamlined through a systematic approach. Here’s a step-by-step guide:

1. Monitor Sentiment Indicators

Utilize tools like the Fear & Greed Index, Twitter sentiment analysis, and crypto news aggregators to gauge real-time market sentiment.

2. Analyze Data Trends

Look for patterns in the sentiment data over time. For instance, if market sentiment has been consistently bullish for several days, this may indicate a strong upward trend.

3. Establish Entry and Exit Rules

Define specific rules based on sentiment thresholds. If sentiment turns overly positive, consider taking profits, while extreme negativity could present a buying opportunity.

4. Combine with Technical Analysis

Use technical indicators like moving averages or RSI to validate sentiment-driven trading signals, ensuring a comprehensive analysis before making a move.

5. Review and Adjust

Continuously evaluate the effectiveness of your strategy. Adjust entry/exit points based on evolving sentiment and market conditions.

Real-Life Examples of Successful Trades Influenced by Market Sentiment

There are numerous instances where market sentiment has played a pivotal role in trading outcomes. One notable example occurred in December 2017 when Bitcoin reached its all-time high near $20,000. The sentiment was overwhelmingly positive, driven by media hype and retail investor enthusiasm. Traders who capitalized on this sentiment during the bullish run were able to lock in substantial profits.Conversely, in March 2020, the crypto market experienced a sharp decline influenced by global panic over the COVID-19 pandemic.

The sentiment shifted rapidly to extreme fear, prompting savvy traders to enter the market at lower price points. Many of these investors saw significant returns as the market recovered in subsequent months, showcasing the effectiveness of sentiment analysis in timing trades.By incorporating market sentiment into trading strategies, traders can enhance their decision-making processes, leading to more informed and potentially profitable outcomes.

The ability to read and react to market sentiment is a crucial skill that can differentiate successful traders from those who struggle in the volatile crypto landscape.

Market Sentiment and Volatility

Market sentiment is a critical driver of volatility in the crypto markets. The emotional responses of traders can lead to significant price fluctuations, often independent of fundamental data. Understanding this interplay is vital for anyone looking to navigate the increasingly turbulent waters of cryptocurrency trading.

The relationship between market sentiment and volatility is particularly pronounced in the crypto space, where news headlines, social media chatter, and influential figures can quickly sway public opinion. When sentiment shifts rapidly—whether due to fear of regulation, excitement over new technology, or reaction to macroeconomic events—the resulting volatility can create both opportunities and risks for traders. A positive sentiment can lead to a bullish trend, spurring buying frenzies, while negative sentiment often triggers panic selling, leading to sharp declines in prices.

This sensitivity makes it essential for traders to not only monitor sentiment but to also understand its implications for market behavior.

Methods to Mitigate Risks Associated with Volatile Market Sentiment

Given the rapid shifts in market sentiment, implementing risk management strategies is crucial for traders. Here are some effective methods to navigate volatility:

- Set Stop-Loss Orders: Placing stop-loss orders helps limit potential losses by automatically selling an asset at a predetermined price, providing a safety net during sudden downturns.

- Position Sizing: Adjusting the size of your trades based on the volatility of the asset can protect your portfolio. Smaller positions can reduce risk exposure during turbulent times.

- Diversification: Spreading investments across different cryptocurrencies can minimize the impact of a significant price movement in a single asset, leading to a more stable overall portfolio.

- Utilize Options: Options can be used to hedge against losses by providing the right, but not the obligation, to buy or sell an asset at a future date, potentially softening the blow from adverse price movements.

Best Practices for Traders Dealing with High Volatility Driven by Sentiment Changes

Navigating a high-volatility environment requires a disciplined approach. Here are key best practices for traders to consider:

- Stay Informed: Keeping abreast of news, trends, and social media discussions can provide insights into market sentiment shifts and help anticipate potential price movements.

- Avoid Emotional Trading: Emotional decision-making can lead to poor trades. Adopting a systematic approach based on analysis rather than emotions aids in making rational choices.

- Use Technical Analysis: Applying technical analysis tools can help identify trends and price levels that might indicate breakout points, thereby informing trading decisions amid volatility.

- Regularly Review Strategies: Given the dynamic nature of crypto markets, regularly assessing and adjusting trading strategies in response to sentiment changes can enhance effectiveness and reduce risks.

- Limit Leverage: Using lower leverage can help mitigate risk, especially in volatile markets where prices can swing dramatically in short periods.

Future Trends in Market Sentiment Analysis

As cryptocurrencies continue to evolve, market sentiment analysis is becoming increasingly vital for investors and traders. Understanding how sentiment influences market dynamics is essential for making informed decisions. Future trends in this area indicate a shift towards more sophisticated and data-driven approaches, significantly enhancing the ability to gauge public opinion and emotional reactions to market movements.Innovative technologies are emerging that may revolutionize how we track market sentiment.

Advanced data analytics, artificial intelligence (AI), and machine learning (ML) are at the forefront of this transformation. These technologies allow for greater depth and accuracy in sentiment analysis, enabling traders to make more strategic decisions based on real-time data and trends.

Emerging Trends in Market Sentiment Analysis

The landscape of market sentiment analysis is rapidly changing, driven by both technological advancements and evolving investor demographics. The following points highlight key trends shaping the future of this analysis in the cryptocurrency market:

- AI-Driven Sentiment Analysis: AI tools are increasingly being used to process vast amounts of data from social media, news outlets, and forums. By analyzing language patterns and emotional tone, these tools can predict shifts in sentiment more accurately than traditional methods.

- Integration of Behavioral Economics: Understanding cognitive biases and emotional triggers will become crucial. Behavioral economics can enhance sentiment analysis by providing insights into how fear and greed influence market movements.

- Increased Focus on Social Media Metrics: Platforms like Twitter and Reddit are becoming key indicators of market sentiment. Monitoring engagement metrics such as likes, shares, and comments can provide real-time insights into investor mood.

- Real-Time Sentiment Tracking Tools: The development of tools that offer real-time sentiment analysis will enable traders to react swiftly to market changes, providing a competitive edge.

- Diversity of Data Sources: Sentiment analysis is expected to expand beyond social media and news articles to include other data sources, like Google search trends and transaction data on blockchain networks.

Innovative Technologies Enhancing Sentiment Tracking

Emerging technologies are significantly enhancing the ways market sentiment is tracked and analyzed. These innovations include:

- Natural Language Processing (NLP): NLP algorithms analyze text data to extract sentiment from news articles, social media posts, and financial reports, transforming qualitative input into quantifiable insights.

- Sentiment Scoring Systems: Systems that assign numerical scores based on detected sentiment allow traders to compare and quantify market sentiment effectively.

- Blockchain Analysis Tools: Tools that analyze blockchain data can provide insights into market sentiment by tracking wallet movements and trading behaviors, offering a unique perspective on investor confidence.

Impact of Changing Investor Demographics on Market Sentiment

The demographic landscape of cryptocurrency investors is shifting, which is likely to influence market sentiment significantly. Younger generations, who are more tech-savvy and engaged in social media, are becoming prominent players in this space. This shift brings several implications:

- Increased Volatility: Younger investors often exhibit higher risk tolerance and emotional trading behaviors, leading to increased market volatility.

- Trend-Driven Investment: A greater focus on trends and community-driven investment philosophies may result in rapid shifts in sentiment, driven by viral content rather than fundamental analysis.

- Social Influence: The role of influencers and online communities will continue to grow, shaping the sentiment landscape and impacting investment decisions significantly.

“As investor demographics evolve, their unique behaviors and preferences will shape market sentiment, driving new trends and innovations in sentiment analysis.”

End of Discussion: Why Market Sentiment Plays A Big Role In Crypto Trading

In conclusion, recognizing the significance of market sentiment in crypto trading can empower investors to make more strategic decisions. By incorporating sentiment analysis into their trading approach, individuals can gain deeper insights into market trends and potentially enhance their trading outcomes. As the crypto market continues to evolve, staying attuned to the emotional currents of the market will be essential for long-term success.

FAQ Corner

What is market sentiment?

Market sentiment refers to the overall attitude and emotional state of investors regarding a particular market or asset, which can influence price movements.

How does fear impact crypto trading?

Fear can lead to panic selling, causing prices to drop as investors rush to exit positions, often resulting in increased volatility.

Can social media affect market sentiment?

Yes, social media can significantly impact market sentiment, as trends and opinions shared on these platforms can quickly sway investor perceptions and decisions.

What tools can help analyze market sentiment?

Tools such as sentiment analysis platforms, social media trackers, and news aggregators can provide insights into market sentiment by analyzing data from various sources.

How can I incorporate sentiment analysis into my trading strategy?

You can incorporate sentiment analysis by monitoring market indicators, news trends, and social media discussions to make more informed trading decisions based on collective investor behavior.